Understanding Saffron Finance

I did not understand tranches. I’ve heard about them, I know people are excited about them, but I did not understand them (I’m still not 100% sure I do), but having spent some time researching and reviewing Saffron Finance, I wanted to do a write up, to both articulate my understanding, and if by some miracle I am right, then hopefully help others understand it as well.

To try to articulate it in my own vernacular I am not going to refer to “tranches”.

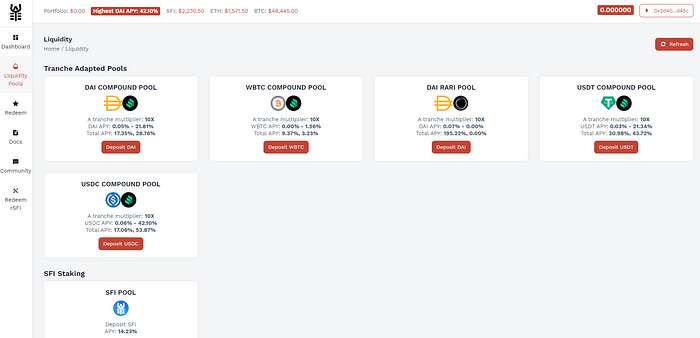

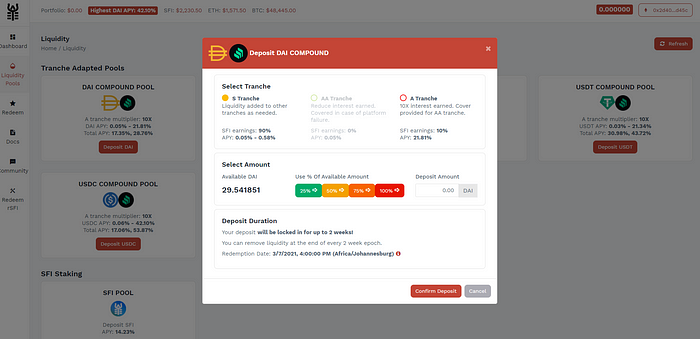

So consider category A. Category A takes DAI and invests it into Compound. But, category A actually earns less interest, than if you just depositing into Compound itself. To understand this, we need to first look at Category B.

Category B simply holds DAI. But category B is “insuring” category A. If something bad were to happen to Category A (like a loss of funds), Category B is essentially taking on that risk. In return for this, Category A is giving category B some of its interest.

So now back to Category A, that is why you are earning less interest, that interest is being paid to Category B “insurers”, but this does mean, your deposits are insured, should something occur.

Now the above is probably a LOT more naïve than the full picture, and I still have a lot more research to do, but I thought this is a really elegant solution to insured products. Reason being, there is no upfront cost for cover, you are simply paying with interest.

Now it does raise questions about “if Category B takes on all the risk of Category A, why not just deposit into Compound and earn full interest”, I don’t have a clean answer on this yet, but I assume that’s where a Category is normally comprised out of more than one “instrument” and as such has different risk diversification, or where Category B can be used to insure multiple other unrelated risk categories, as the same DAI could be used to insure Category A Compound and Category C Aave.

The above is just the start, but its a model I’m very excited by, since it alleviates the upfront costs of insurance, and shifts it to ongoing. Something that I have proposed with Cover Protocol as well. Great to see difference solutions to the same problem.