Keep3r expansion and consolidation

- vKP3R

- Keep3r olm (options liquidity mining)

- Keep3r Fixed Forex

- Keep3r v3 liquidity incentives

- DeFi Wonderland

- Keep3r Eden

Introduction

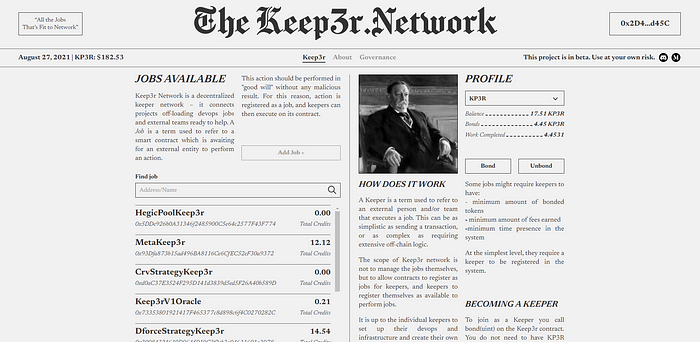

The original design goal of Keep3r was simple, an on-chain first, job registry, for keepers and projects needing upkeep. Interacting was simple, implement the upkeep interface, register your job on the kp3rV1 contract, then choose to fund your job via ETH (opex), ERC20 (opex), or liquidity credits (capex). Liquidity credits are earned by providing KP3R/ETH liquidity. Once a job is funded and isWorkable() returns true, keepers execute work(). That simple.

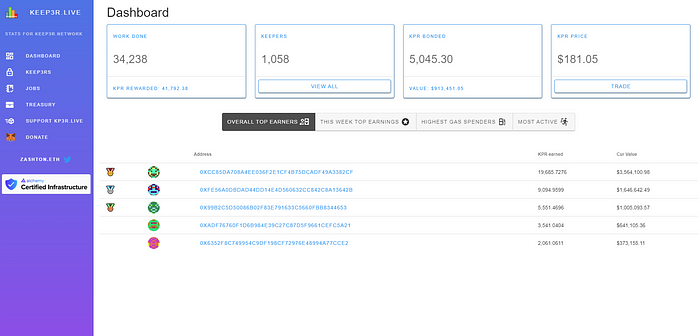

Keep3rs currently maintain 19 projects across 45 jobs with 34,238 upkeeps.

View live stats at keep3r.live

Moving forward

What was originally a simple job registry, I’ve come to realize is actually a liquidity ecosystem. Liquidity credits can fund much more than jobs, they can fund projects, liquidity mining, and more.

As such, I am consolidating all of my projects under the Keep3r ecosystem, this includes; options liquidity mining (olm), fixed forex, and my previously unannounced v3 liquidity incentives.

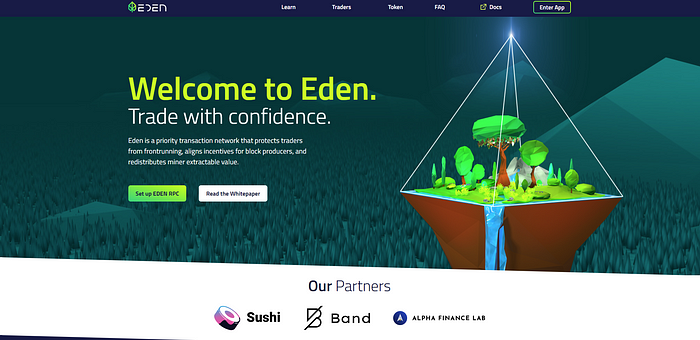

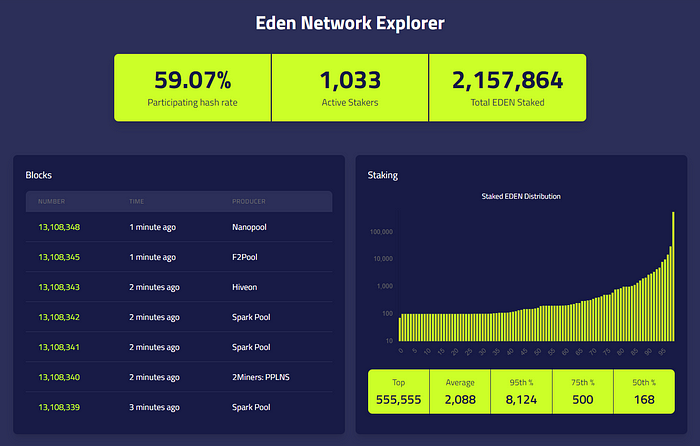

Keep3r Eden

Eden provides a fair and transparent rule set to order transactions within a block. This is valuable for Keep3r as we can protect keepers & jobs from frontrunning while having priority access to block space. Over half of Ethereum hashpower is on the Eden Network.

Keep3r has formed a strategic partnership with Eden Network. Keep3r has acquired 602,409 EDEN to give it probabilistic certainty that it will be an anchor slot tenant.

This allows Keep3r jobs to by default (if they use the kp3r proxy) have;

- MEV protection

- Front running protection

- Priority block inclusion

And further if they use the Eden RPC;

- Private transactions

Keep3r’s Fixed Forex

Fixed Forex launched as a liquidity incentive and fee claim system for Iron Bank’s Fixed Forex. Current TVL is $115m, available liquidity is $40m, fees are earning $30k/week from issuance and an additional $30k/week from Iron Bank fees.

IBFF, and veIBFF will be merged with KP3R, and vKP3R.

veIBFF holders will receive ~1:17 vKP3R at a future snapshot, weekly emission will switch from 200 veIBFF to 4000 vKP3R.

Fee claim (~$60k/week) will move to vKP3R.

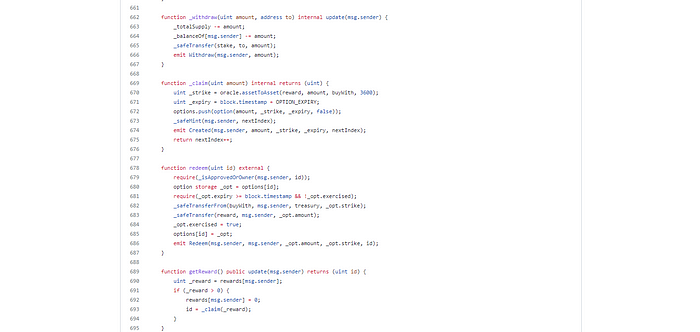

Keep3r OLM (options liquidity mining)

Keep3r is launching a generalized OLM platform for projects (post audit), simply choose your reward_token, stake_token, twap discount, and expiry extension and you have instant options based reward incentivization program. 1% of exercised option fees will go to vKP3R holders.

Keep3r will begin a KP3R/ETH olm program, the options will be set to TWAP -50% and expiry +7 days. All exercised options fees will go to vKP3R holders. KP3R/ETH will target 50% APY at $20m liquidity.

At current market values, ~$100k/week in fees to vKP3R holders.

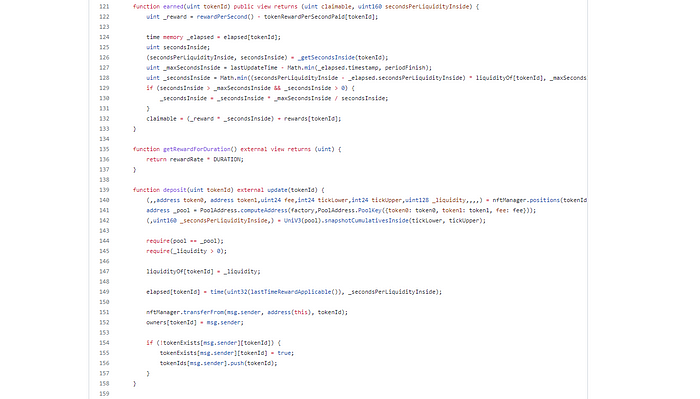

Keep3r v3 liquidity incentives

Keep3r v3 liquidity incentives will be launching a liquidity mining program for uniswap v3 (post audit). All liquidity pairs are supported. LPs can deposit their uni v3 NFT positions and earn KP3R incentives on their active liquidity. 50% of fees will be distributed to vKP3R holders.

Keep3r wonderland

Keep3r tokenomics v2

The tokenomics were never designed with speculative use in mind, sadly, due to how the liquidity credits systems works, it required on-chain liquidity, further to this, it required that unknown entities could purchase KP3R to fund KP3R/ETH to receive credits. There is no way for the system to differentiate between a job funder or speculative user.

With v2, we took speculative users into consideration, as such, keep3r will no longer have open ended emission, instead it will have isolated liquidity mints, decreasing gradually over 4 years.

Each isolated sub project will receive a weekly cap target, these targets can be reviewed if required.

- Keep3r v1 jobs will receive a weekly limit of 1k KP3R

- KP3R/ETH olm receives a weekly limit of 1k KP3R

- v3 liquidity incentives weekly limit 1.5k KP3R

Lastly, Fixed Forex, which distributes vKP3R and not KP3R, will receive 4k/week, since to receive 1 vKP3R = 1 KP3R it requires a 4 year lockup, this equates to 1k/week.

1% of all future emissions will be sent to the treasury to fund future development.

The treasury may optionally mint for purposes of farming with treasury funds to sustain future growth.

Summary

- Introduce vKP3R

- Fixed Forex and Iron Bank Fixed Forex fees distribute to vKP3R

- vKP3R used to vote on Fixed Forex KP3R emission and pool allocation

- KP3R/ETH olm twap -50%, expiry +7 days program targeting 50% APY at $20m liquidity

- KP3R/ETH exercise fees distributed to vKP3R

- Keep3r generalized olm program with 1% exercise fee, distributed to vKP3R

- Keep3r v3 liquidity incentives with 50% trading fees, distributed to vKP3R

- Keep3r capped emission schedule

- Keep3r Wonderland v2

- Keep3r Eden MEV protection, private transactions, and priority block inclusion